St. Patrick’s Day: The Backstory

- Mar

- 15

- Posted by Carroll Marshall Insurance

- Posted in Central Florida Life Insurance, Disability Insurance, Hazard Coverage, Insurance Industry, Polk County Insurance, Winter Haven Health Insurance, Winter Haven Life Insurance

St. Patrick’s Day, or The Feast of St. Patrick, is a well-known holiday, known for fun (and sometimes crazy) parties all over the United States. Shamrocks are abundant and you’ll be seeing in the color green just about everywhere you go on March 17th. However, many people celebrate the holiday without ever knowing WHY they […]

read moreParty at The Pool! Make a “Splash” with Your Halloween Bash This Year

- Oct

- 25

- Posted by Carroll Marshall Insurance

- Posted in Event Insurance, Hazard Coverage, Insurance Industry, Polk County Insurance, Winter Haven Homeowners Insurance

Holidays in Florida always seem to look a little different. Christmas? Sometimes we wear flip-flops and grill out. Thanksgiving? Seafood is a great alternative to turkey! We’re used to doing things our own way here. Halloween is around the corner, and it’s time to start thinking about how you’ll be celebrating. We might not have […]

read moreCelebrate Dad This Father’s Day!

- Jun

- 12

- Posted by Carroll Marshall Insurance

- Posted in Central Florida Life Insurance, Disability Insurance, Hazard Coverage, Insurance Industry, Long Term care Insurance, Polk County Community, Polk County Insurance, Winter Haven Health Insurance, Winter Haven Life Insurance

With Father’s Day right around the corner, you’re probably planning what you are going to do for your dad (or Father figure) to make his day special. At Carroll Marshall Insurance we know how important dads are in one’s life, and how important it is to make them feel loved and appreciated on their big day. […]

read moreIs Your Plan Ready to Stand the Test of Time? Keep Your Homeowner’s Policy Up to Date!

- Apr

- 27

- Posted by Carroll Marshall Insurance

- Posted in Hazard Coverage, Insurance Industry, Polk County Insurance, Winter Haven Homeowners Insurance, Winter Haven Motor Home Insurance, Winter Haven Renters Insurance

In a world of crazy schedules and more than you fair share of things to keep up with, it might feel like insurance policies are a “set it and forget it” deal, but is that actually true? Well, not really. While insurance policies don’t require daily, weekly, or even monthly “maintenance,” they do require some monitoring, […]

read moreLove It? Insure It!

- Feb

- 17

- Posted by Carroll Marshall Insurance

- Posted in Central Florida Life Insurance, Disability Insurance, Hazard Coverage, Insurance Industry, Long Term care Insurance, Pet Insurance, Polk County Insurance, Travel Insurance, Wedding Insurance, Winter Haven Auto Insurance, Winter Haven Business Insurance, Winter Haven Event Insurance, Winter Haven Health Insurance, Winter Haven Homeowners Insurance, Winter Haven Life Insurance, Winter Haven Motor Home Insurance, Winter Haven Renters Insurance

Insurance seems to be one of the “routine” parts of adulthood that many of us take for granted, but with love on the minds of many people throughout the month of February, we think this is a great time to remind you of the value of quality coverage from solid providers. Without insurance, many of […]

read moreJust Starting Out: What Young People Should Know About Their Coverage

- Jan

- 28

- Posted by Carroll Marshall Insurance

- Posted in Central Florida Life Insurance, Hazard Coverage, Insurance Industry, Polk County Insurance, Winter Haven Life Insurance

If you are just starting out as an adult, you already know that there are plenty of traits that set your generation apart from those before. Technology, economy, politics, major world events (like COVID) and more have shaped the world we live in and the way you grew up, and therefore impact how you think […]

read moreGiving THANKS for Health Insurance!

- Nov

- 20

- Posted by Carroll Marshall Insurance

- Posted in Hazard Coverage, Insurance Industry, Winter Haven Health Insurance

It’s that special time when the temperatures are getting cooler, families are finally making travel plans to be together after many months apart, and people are putting together their Thanksgiving Day menus with anticipation. The holiday season is indeed one of the most wonderful times of the year, and everyone at Carroll Marshall Insurance is […]

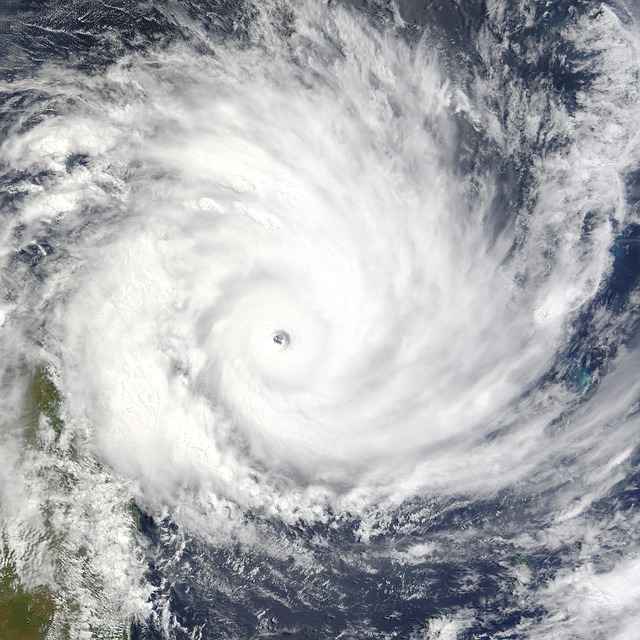

read moreHow To Prepare For Hurricane Season

- Jul

- 12

- Posted by Carroll Marshall Insurance

- Posted in Boat Insurance, Hazard Coverage, Insurance Industry, Polk County Community, Polk County Insurance, Winter Haven Community, Winter Haven Homeowners Insurance, Winter Haven Motor Home Insurance, Winter Haven Renters Insurance

Hurricane season has officially arrived in Florida! As hurricane season starts at the beginning of June to the end of November, many Floridians stack up on extra water, food, batteries, generators, and more. But, don’t let these things be the only things you do to prepare. Along with the housing damage that hurricanes and tropical […]

read moreSummer Biking in Florida: What Motorcyclists Need to Know

- Jun

- 28

- Posted by Carroll Marshall Insurance

- Posted in Hazard Coverage, Insurance Industry, Polk County Insurance, Winter Haven Auto Insurance, Winter Haven Community

Summer in Florida means sunshine, long (hot) days, and plenty of time enjoying the outdoors. Few people know this better than motorcycle owners. If you enjoy traveling by bike, you understand the delight in feeling the wind and sunshine firsthand as you hit the highway. Unfortunately, there are many risks that come along with taking […]

read moreDon’t Rely on Luck! Know the Facts About Worker’s Compensation Insurance

- Mar

- 05

- Posted by Carroll Marshall Insurance

- Posted in Hazard Coverage, Insurance Industry, Polk County Insurance, Winter Haven Business Insurance

Do you have luck on the brain as we approach St. Paddy’s Day? While it’s fine to lean on a little bit of luck when you roll the dice, play a scratch-off ticket, or open a blind bag surprise, depending on luck to protect your employees at work is a risk you shouldn’t be taking. Worker’s […]

read moreSince 1952

Carroll Marshall Insurance in Winter Haven, Florida is your hometown insurance agency. Call us today! (863) 293-1111

Our office in downtown Winter Haven is open Monday - Friday 8 a.m.- 5 p.m.

View Larger Map